The Brief

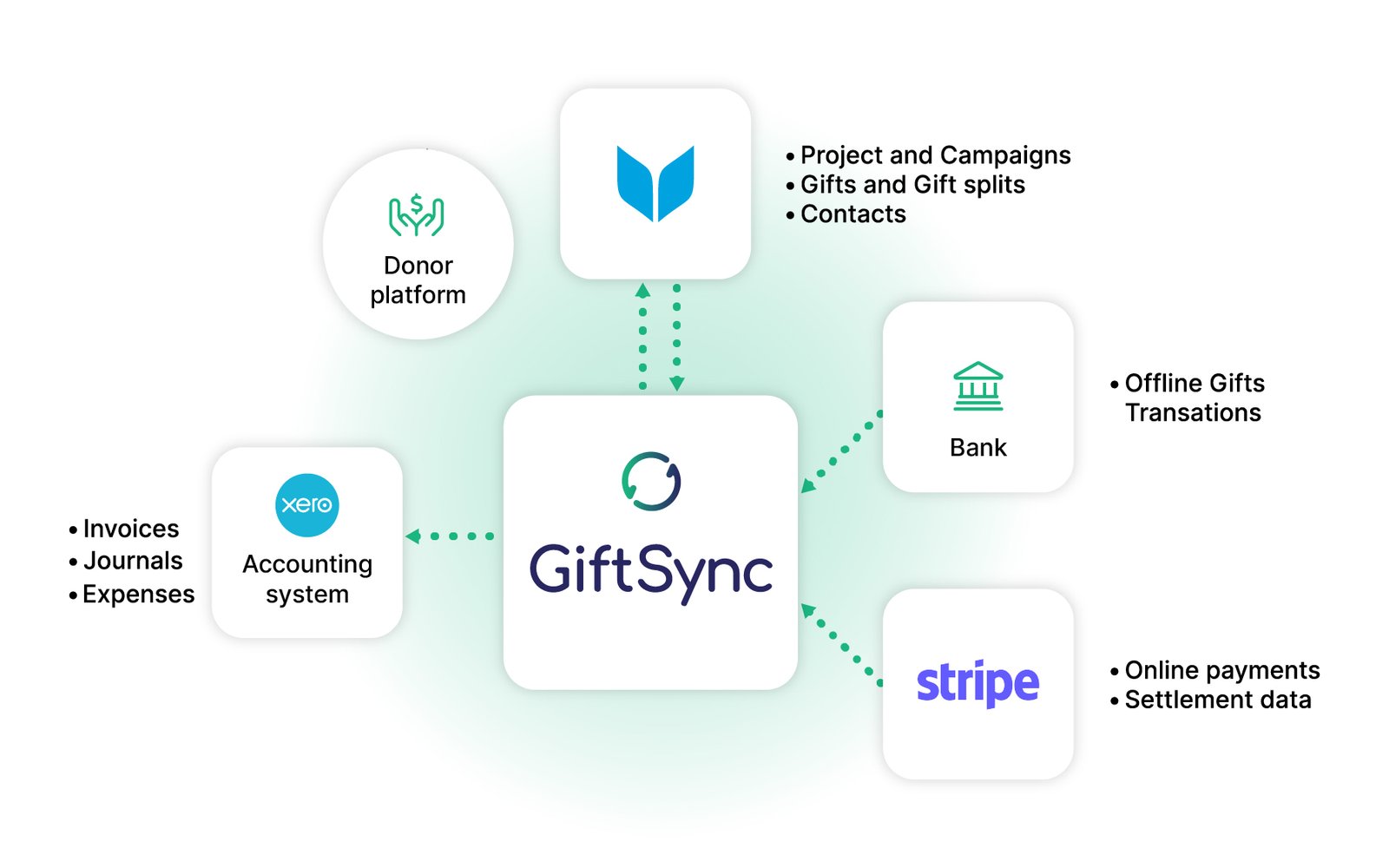

The core challenge for non-profit organisations was the fragmented flow of donation data, necessitating significant manual effort for reconciliation across multiple systems (Stripe, bank statements via CSV, Virtuous CRM, and accounting software like Xero/QuickBooks/MYOB). This resulted in “time-consuming and error-prone manual reconciliation” and inconsistent data. The solution was developed as a Minimum Viable Product (MVP), prioritising speed-to-market and robust integration focus.

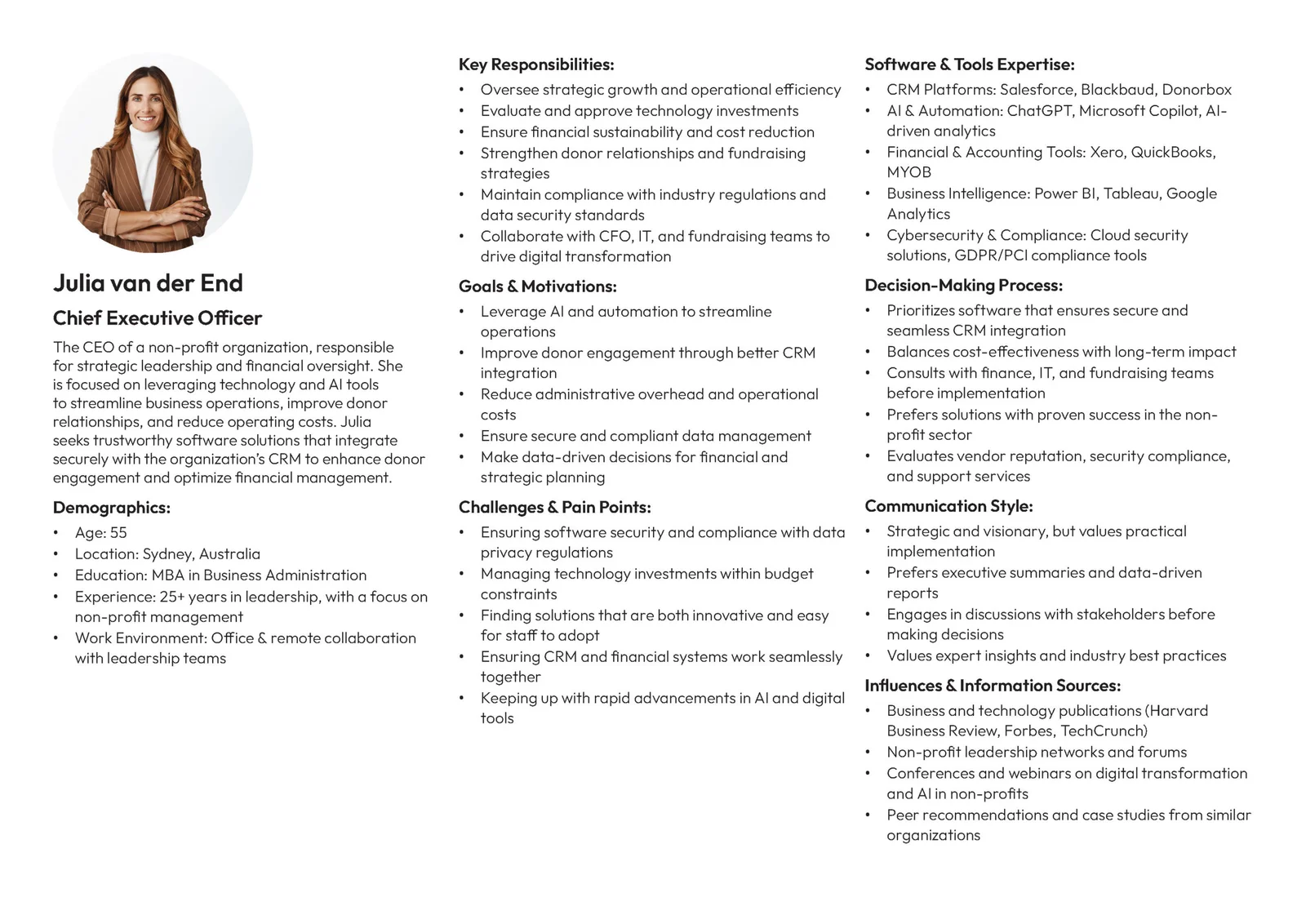

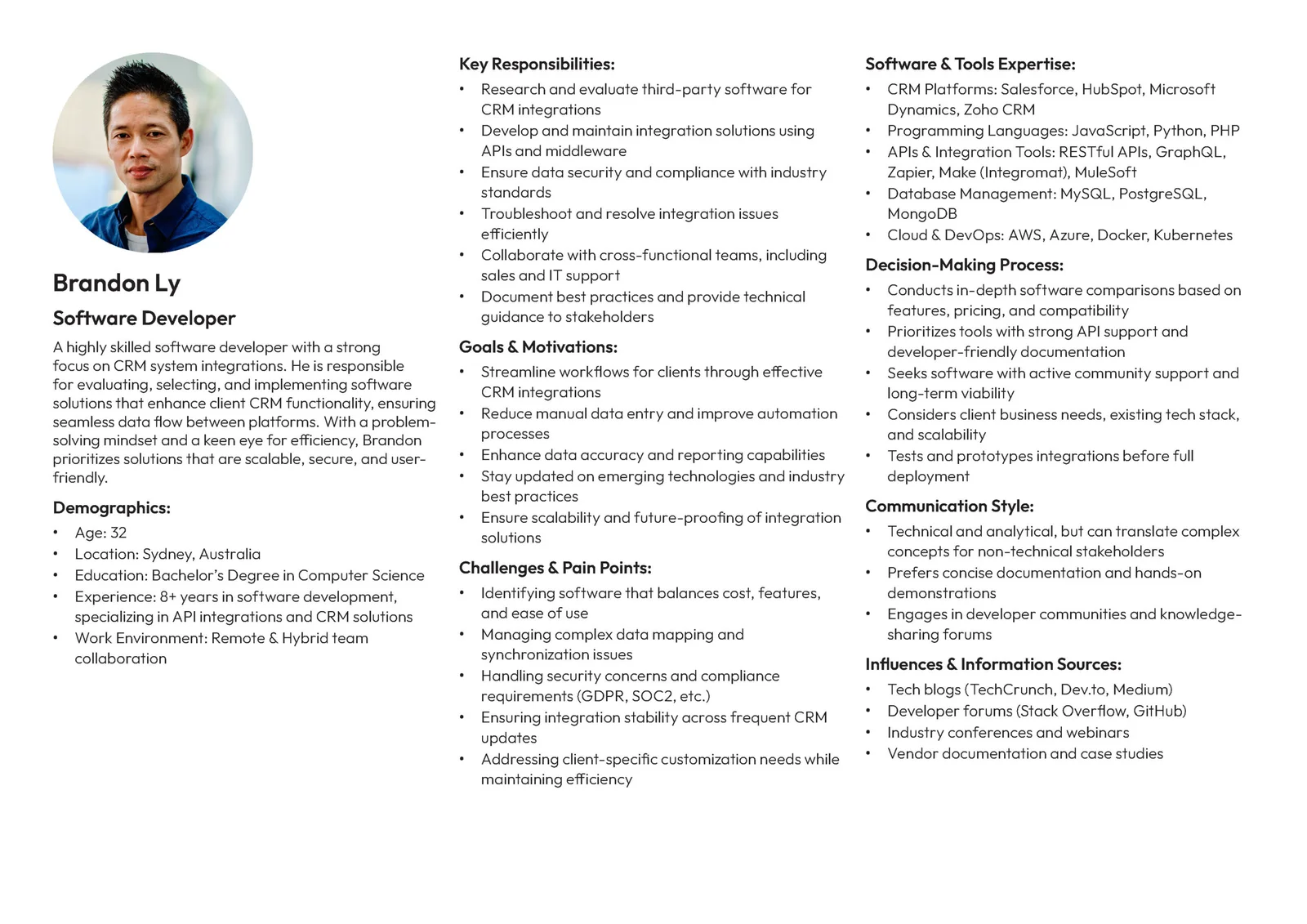

Key Stakeholders: Non-profit Bookkeepers, Software Developers, and Organisational Leaders/CEOs.

My role

My role encompassed the end-to-end product design and solutioning, establishing the brand and the core UX/UI of the application.

- Brand Development: Developed the GiftSync brand identity to convey reliability, precision, and innovation, defining the visual identity, tech-friendly colour palette, and legible typography essential for financial data display.

- UX/UI Execution: Led the UI design using existing React prebuilt component libraries for rapid prototyping and speed-to-market.

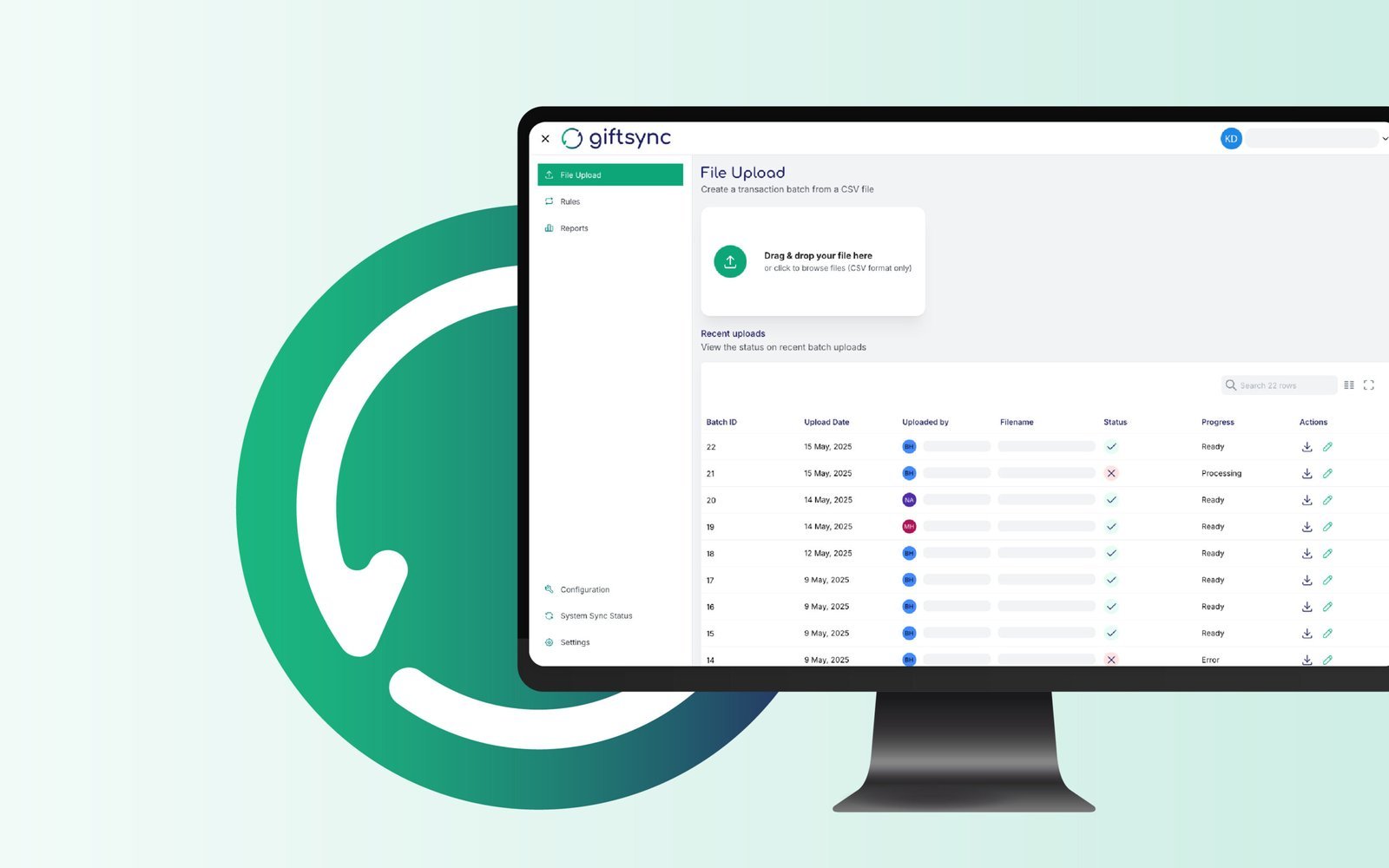

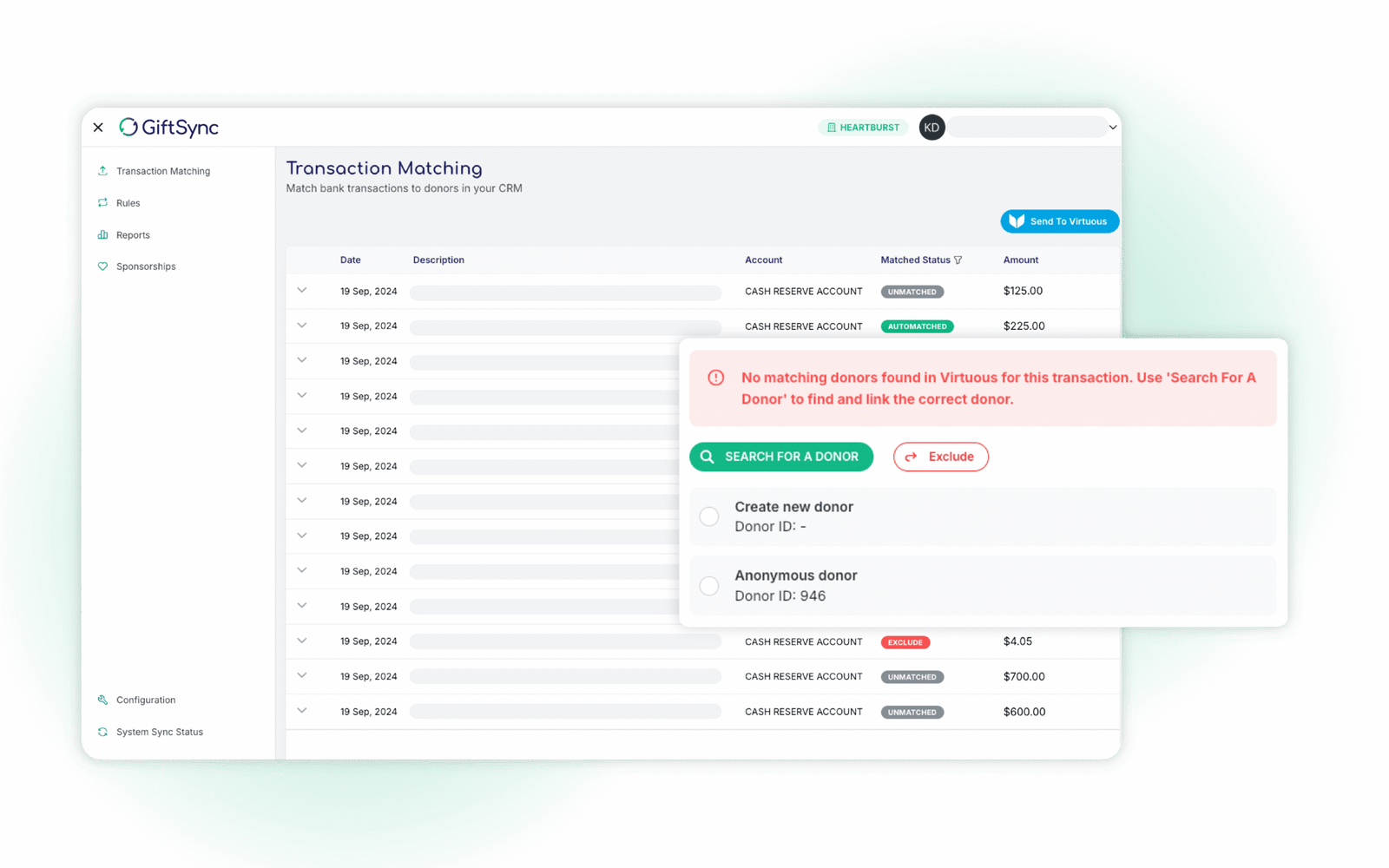

- Complex Workflow Simplification: Designed intuitive navigation and a streamlined Transaction Matching workflow, which used visual cues (“MATCHED,” “UNMATCHED”), Suggested Matches based on configurable rules, and clear feedback mechanisms to guide users through complex reconciliation tasks.

Outcomes

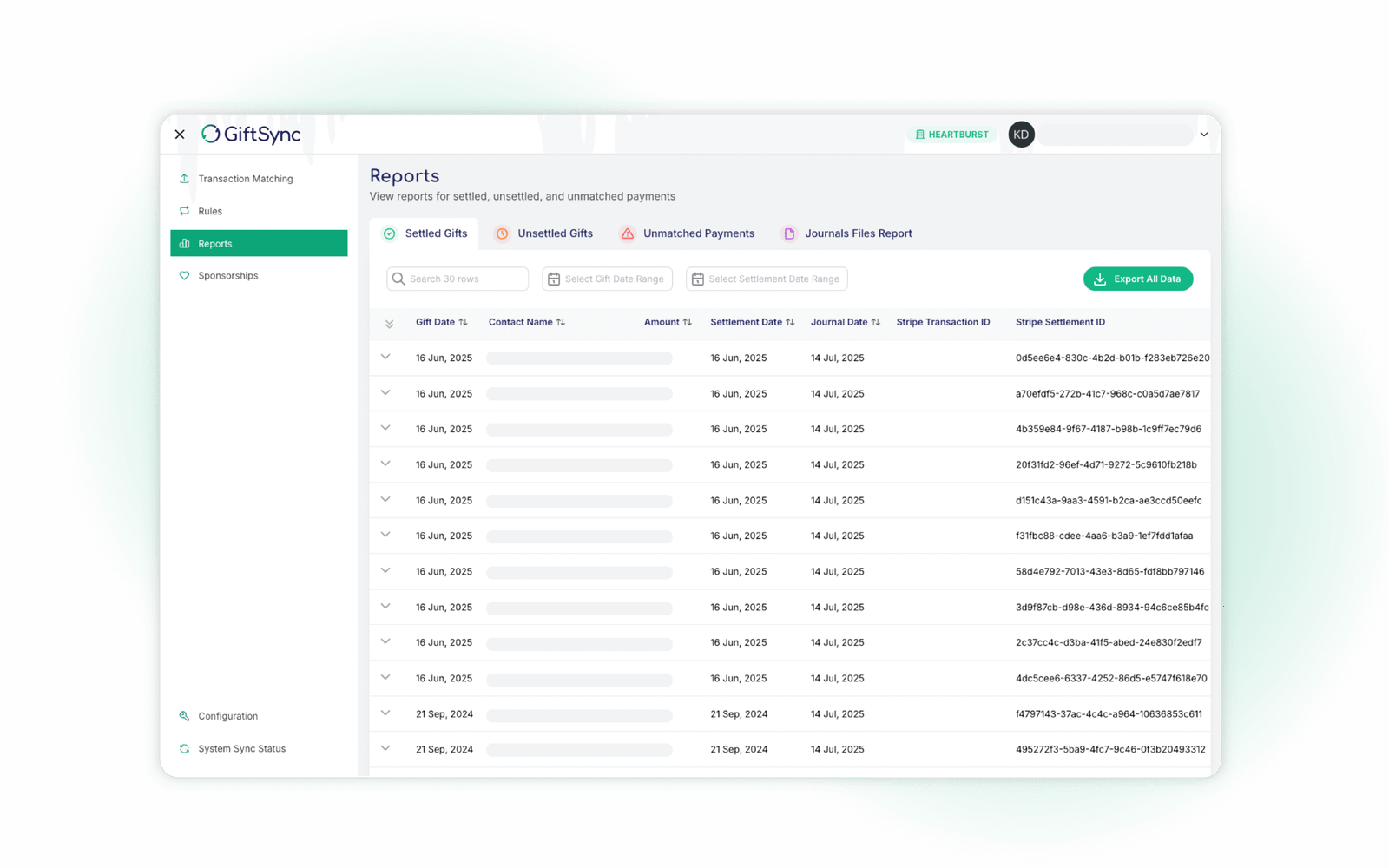

The MVP successfully addressed critical pain points by automating complex financial reconciliation processes. The solution provided immediate value by reducing manual effort and improving data accuracy, laying a foundation for future financial oversight.

- The design delivered a consistent and robust interface that aligned with the new GiftSync brand while meeting the aggressive speed-to-market requirement.

- It established robust integrations between the disparate systems (CRM, payment, accounting, bank data) as initially scoped for the MVP.

- The transaction matching interface simplified a historically challenging bookkeeping task, making the intricate financial process more intuitive.

Success criteria

Significantly reduced manual effort and improved data accuracy in financial reconciliation for non-profit organisations. The solution successfully leveraged persona-driven design and real-world client feedback to address immediate and pressing needs for a specific client.

Reflections

While the tight focus on core integrations was necessary for the MVP, I learned that ensuring a strong user experience must be balanced with the MVP’s technical focus. I would have pushed for earlier integration of more sophisticated, customisable matching rule logic to further reduce the need for any manual intervention for the bookkeepers.